AFP established and administers the Certified Treasury Professional and Certified Corporate FP&A Professional credentials, which set standards of excellence in treasury and finance. and located regionally in Singapore, the Association for Financial Professionals (AFP) is the professional society committed to advancing the success of treasury and finance members and their organizations. Headquartered outside of Washington, D.C. If you are a member of the press and would like a copy of the survey or have any questions, please contact Melissa Rawak at. It generated 622 responses from corporate finance professionals across industries. To think that change doesn't happen doesn't make it go away.”ĪFP conducted the survey in September 2019. “All the numbers in your project analysis are changing,” he said. Professor Damodaran recommended practitioners stay agile in re-valuing the project cash flows, the cost of capital, and especially the decisions after they are made. The constructed cost of capital for a company should never be a constant for the whole year.” You've got macroeconomic shifts, and people are still doing what they used to do. You've got interest rates that are lower than the rates you have faced for close to a century. You've got distrust of central banks, government and experts.

Addressing the survey results about frequency of updates, Damodaran observed, “There is a lot of consistency from 2013 to now, in terms of the calculation methodology and how it was applied, but consistency is not always a good thing because the world has shifted. According to Professor Aswath Damodaran from New York University’s Stern School of Business, finance departments have some catching up to do. One area that did not change was the cost of capital calculation. Operating expense (Opex) projects differ from capital expense (Capex) projects in dollar size, project duration, and the choice of evaluation metrics.38% of companies have adopted agile methodologies, but have not put in place all the mechanisms to become truly agile.60% of companies use five or more financial metrics to evaluate projects, and 27% use 10 or more.“The pace of change in the market is so fast-for companies and for products-that FP&A practitioners have changed their evaluation methods to adapt and be more responsive,” said Jim Kaitz, president and CEO of AFP. Only 49% reported that they use terminal value (TV) as part of their evaluation, a decrease from 82% in 2013, and 51% of all projects evaluated are 12 months or less in duration. The survey focuses on the process of project decision-making and how FP&A departments are savvy business partners that deploy corporate capital effectively.Ĭomparing data from 2019 with that of 2013, the survey revealed that 41% of respondents analyzed less than three years of project investment cash flows, an increase from 11% in 2013. Janu- Increasing volatility in product lifecycles is causing finance to shorten the time period analyzed for cash flows and demonstrate a preference for non-valuation metrics, according to the 2019 Association for Financial Professionals (AFP) Project Investment Decisions Survey.

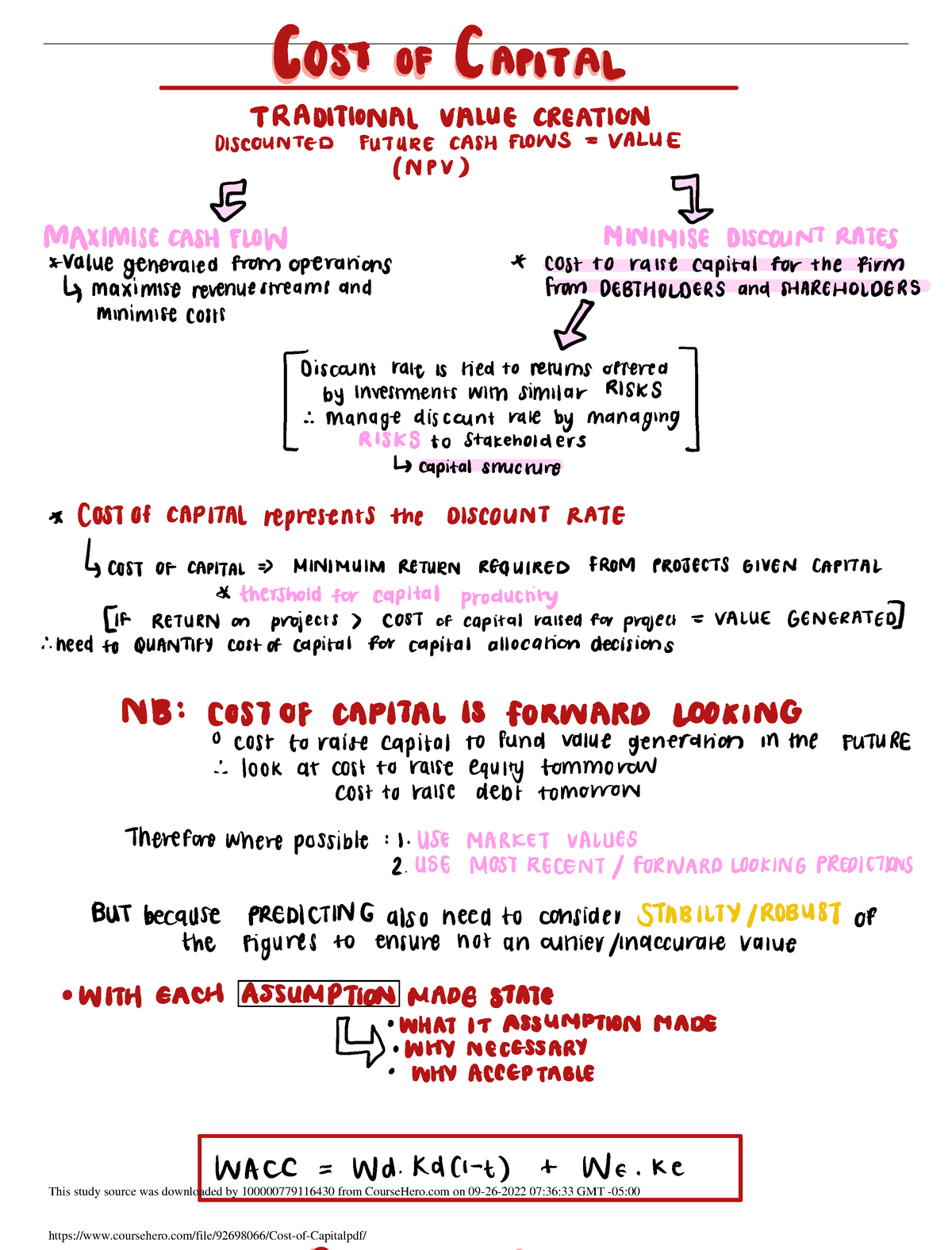

The study concludes that practices with respect to analyzing capital investment decisions in higher education would tend to lead to overinvestment and makes recommendations as to how WACC analysis could be applied, even within the context of higher education.Survey: Finance Revises Project Analysis, But Cost Of Capital Practices Lag The 2019 AFP Project Investment Decisions Survey reveals that corporate finance is shortening the timeframe and decision criteria of analysis, but calculating the hurdle rate remains unchanged. A survey of 69 higher education professionals was conducted and this study reports on which techniques are used, perceived obstacles to more rigorous quantitative analytical techniques, and differences between private and public institutions. This study reviews the analytical techniques taught in textbooks used in masters programs oriented toward not-for-profit students with traditional MBAs and finds WACC analysis is not widely taught. The use of less rigorous techniques can result in overinvestment and corresponding cash flow pressures. Finance professionals in large for-profit organizations overwhelmingly evaluate alternative capital investment options by performing net present value (NPV) analysis using the weighted average cost of capital (WACC) as the discount rate.

0 kommentar(er)

0 kommentar(er)